I personally always find it worthwhile hearing opposite points of view and like to be challenged so I can more often than not come to a more nuanced accurate view of things. I have therefore spent the past few days researching the many criticisms of the FIRE movement that different people have put across in various articles across the Internet.

I wanted to pick some of the common themes that come up and then paraphrase parts of those views followed by sharing what I personally think of them. I have found a kernel of truth in these particular criticisms and I have chosen these precisely for that reason. I’d love to then hear what you also think in the comments as always.

1 -It requires deprivation

I would say by far the most common negative theme is that in setting out on a journey towards FIRE, you will be deprived in different ways. There is essentially going to be deprivation of happiness in the here and now.

Living life on fast forward, waiting for the FIRE date

You work a job you really dislike. The thing that keeps you going is this future in which things will be so much better. You will no longer need to work for the man. You will be free, free to live your life to the full. Checking your spreadsheet and using a FIRE calculator provides so much joy. You have a countdown clock and cannot wait for the time to come, 3 years, 7 years, 18 years.

The problem is though that Life is for living now, you need to stop sacrificing your life now and rushing towards a future utopia that will not be the perfect dream you imagine, life doesn’t work that way. Live your best life now! You could be dead tomorrow.

My own thoughts

I think the brunt of this argument is that you will not be living your life now to the full if you pursue FIRE as a goal. You will be in essence wanting to fast forward life to this point of trigger pulling and that will be at the expense of now as you will be more focussed on the future than the present.

I think there is some truth to this but that applies to almost any pursuit or goal and isn’t just about FIRE. It’s all about the balance of wanting to enjoy life now whilst still wanting to improve things and having things to look forward too. If we truly did live like it was or very likely could be our last day on planet Earth, we wouldn’t go to work and would probably spend the day quite down to be fair.

If we were always 100% content with what we had, there would be little progress in the world. It’s good to both want and work towards something new or different whilst still wanting and enjoying what you have already. It’s the great challenge of life. I have been very conscious of this over the last year or two and have really tried to pull back a lot of focus to how I can get more joy out of life right now.

I do therefore certainly agree that people can be obsessed with this imagined idyllic future after FIRE which could then distract from the here and now a little but having joy looking forward to FIRE and reminding yourself of why you are doing this can also bring joy to the here and now. It’s worth remembering after all that moving closer towards FIRE and even simply having it as an option can bring so many benefits to the here and now, especially the closer you get. Becoming debt free, having some emergency cash buffer, lower expenses, having a few months of money in reserve to a few years really does help the here and now after all.

Extreme Frugality and life restrictions

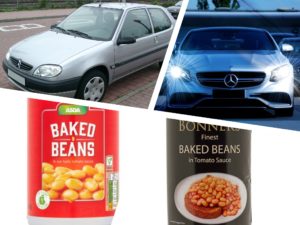

Enjoy drinking that coffee with friends? Enjoy the intense physical workout at your local gym? what about taking your other half for a few drinks and a meal at the local pub? All of this will likely need to stop to help achieve that 50 to 70% savings rate. You shouldn’t own any nice cars or expensive objects. You will need to live on beans and rice, buy only second hand clothes, better yet if you can make your own clothing then that would be good. If you enjoy regular holidays abroad then all of this will have to stop too.

You will need to penny pinch and downscale in almost every area to make this dream a reality. You will likely feel guilt at every opportunity or thought of spending money, this is no way to live!

My own thoughts

This is probably the most common attack on the FIRE movement I have seen. You will be depriving yourself right now by not enjoying life to the full. This is because you are withholding all the cash you invest from providing you a whole multitude of things right here and now. This might include such things as holidays abroad all the way to that new kitchen or Mazda MX5.

I completely get this argument and have even wrote a separate blog post on the subject itself. From my own experience, I think I was in the early days slightly depriving myself and have since loosened up a little and do not feel so guilty when spending money on things I completely value and get joy out of. The key point here for me though is the value of that new kitchen or holiday abroad is so personal and subjective.

There can be many cheaper ways to have fun and enjoy life but I wouldn’t want to say person x is absolutely wrong because he enjoys driving a nice car for example. It would be better to look at what you spend money on and find out if it really does make you happy.

I do not feel like I am depriving myself for example by not wearing jewellery or designer clothes or by not staying in 5 star hotels abroad but I would if I couldn’t buy a PlayStation 5 on launch or a new iPad when mine starts to die because I get so much value out of those things. I enjoy eating out at restaurants occasionally and having takeaways whereas other people might get no real joy from those things and prefer to stay in and cook a family meal and play 2nd hand board games. The key for me is are you feeling deprived, are you feeling like you want to go out more with friends but don’t because you’re worried about spending a few extra quid, if you don’t then I wouldn’t worry about this criticism but it’s certainly got validity.

There is of course the fact that there will no doubt be a balance of judging the future benefits of FIRE and then as a result choosing to have less holidays or days out etc or less experiences and purchases in general but I feel comfortable with this as I feel I already sit at a table with a huge banquet in front of me of things to do and enjoy as it stands and adding an extra variety of food to the table will not bother me all that much if I still can’t finish what’s on the table to start with. As with the previous criticism it is also worth remembering the benefits in the here and now that pursuing FIRE brings, it can make how you relate to work completely change in there here and now.

You can feel so much more secure by having even small amounts of FU money, and it can get rid of so many of those money related worries that the majority of people can and do indeed have. It is not simply about benefits being delayed and only seen in the future.

2 – Early retirement is not so good

Another common theme of criticism is whether or not early retirement itself is really a good thing in the first place. You will be bored, you will lose a sense of self and identity. You won’t be able to relate to your friends in the same way as you could before. The early retirement life choice is just not really a wise choice in general, not for society at large or for you yourself.

What will you do? It won’t be as you imagine