I have done a post previously on what financial independence means to me but I wanted to now write it from a slightly different and more interesting angle fitting more of where I am now along the journey. I thought it would a good idea to construct a few different scenarios and paths towards FI. This is also good timing for me as I will be coming towards the end of Project 2235 next year and will likely commit towards one of these such paths. An important reason for this possible change is due to the income from my second side hustle coming to an end after three years (£500 less per month). Also, as a reminder, Project 2235 is essentially a big target of mine to reach a portfolio of £250,000 (Base bare bones FI) at the end of 2022 when I will just about by a whisker still be 35 years old.

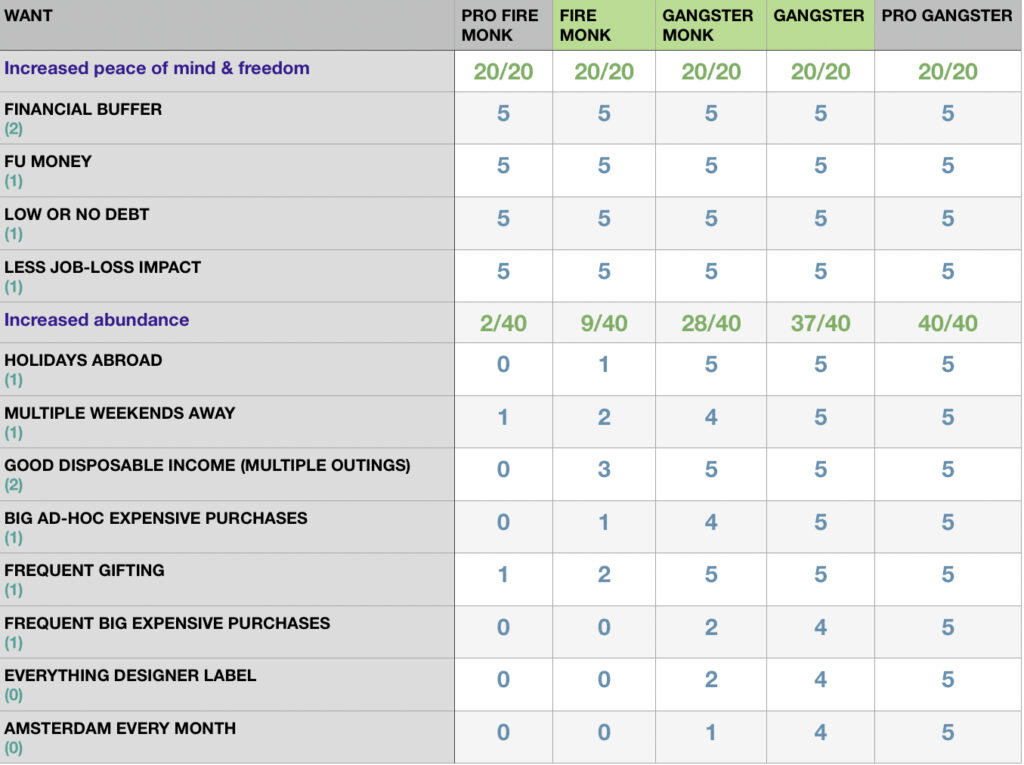

After detailing these different paths, I will then focus on some different attributes and circumstances where financial independence and finances influence in ways that matter to me, specifically when it comes to that all important lifelong happiness. I will then score and rate how my different paths help in achieving these whilst also adding in a few others that might not matter so much to me personally but might to others just to make it more interesting and fun. From these scorings, I should then be able to choose the path with the most points overall. I will weight the attributes in scores according to their importance to me.

Once I have done this, I will then look at reviewing which path I would choose if I were to start again from scratch with different circumstances. I will update the paths timeframe to FI and the scores accordingly.

General Paths to take

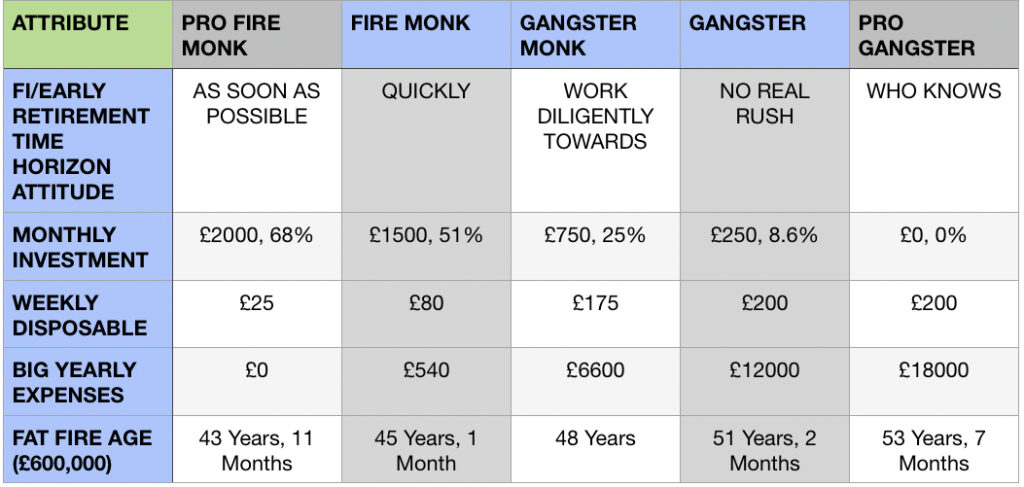

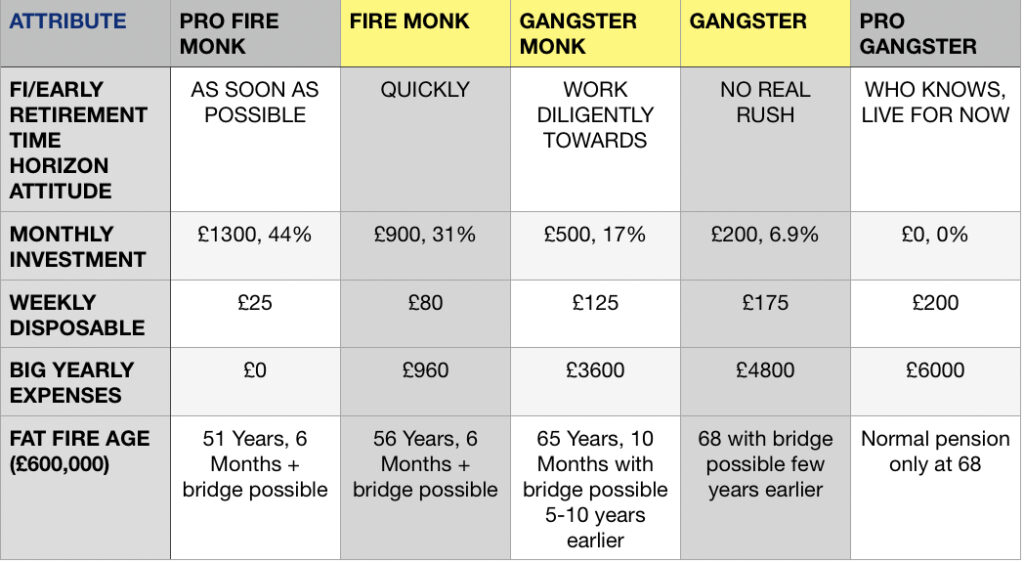

Below shows different paths I could take towards FI given my current circumstances. I chose the amusing two opposite ends of the spectrum of being a Monk where almost no money is spent other than bare bones outgoings and that of a gangster where nothing was saved/invested and everything was spent, I then included some more middle ground strategies. I know though that there are many variations of these one could take and I could also look to improve salary, get another job etc to change this even more but these are the base level paths for myself as it stands with my projected portfolio as of next December (End of Project 2235).

Age 35 (Mortgage free, £250,000 Portfolio – Main job with a side hustle)

It’s worth clarifying that I am currently more or less in the same position as Gangster monk when it comes to weekly disposable albeit slightly less and have about three quarters of the yearly big expenses fund due to my 2nd side hustle which as previously mentioned is unfortunately coming to an end after 3 years and I will then be £500 a month down on my current income. This is a big reason for looking at a possible strategy change as I am currently happy with things as they are at my current income and I don’t wish to get another side hustle unless it involves almost zero effort to replace the £500!

What do I actually want out of life? Why Pursue FI?

I could probably write a ten part series on this topic but I certainly won’t be doing that right now :). So… If I was to focus in on just a few key areas of importance to me in the grand living of life that would cross over with financial circumstances then I would highlight the following.

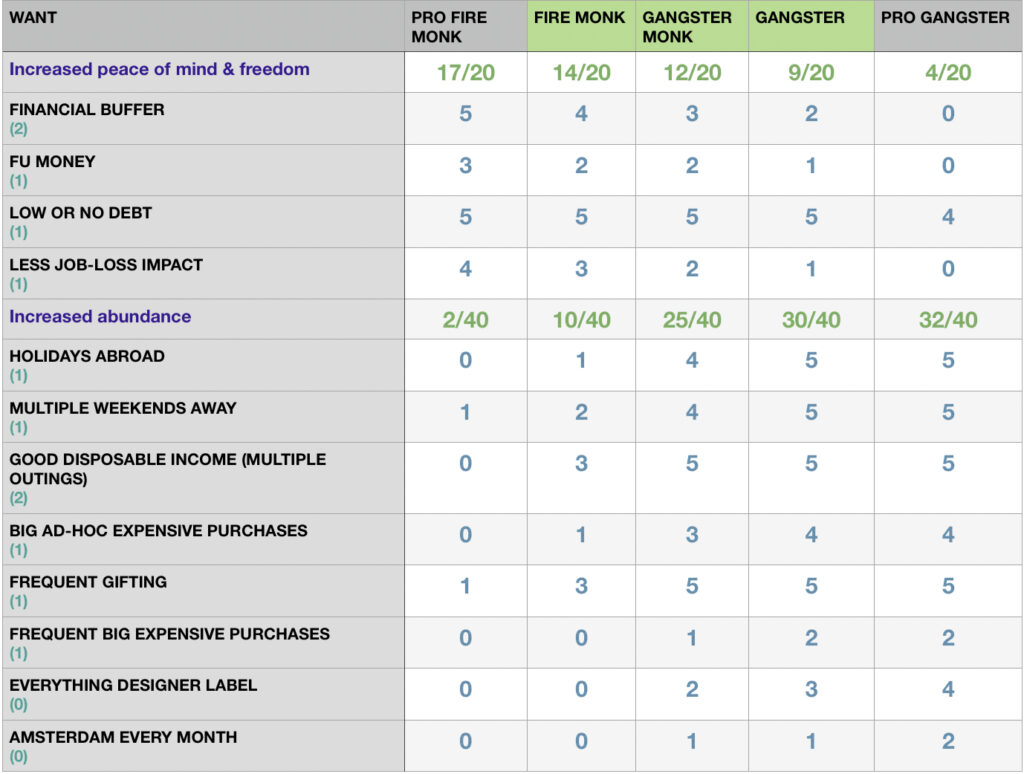

Increased Peace of Mind & Freedom (Remove negatives)

When it comes to finances impacting your life, it is often due to the lack thereof no doubt. As much as there can be different unique problems with being a multi-millionaire, it’s pretty much the not having of money available that cause many of life’s worries and problems. One of the biggest benefits for me out of working towards Financial Independence has been the bonuses picked up a long the way, some of which are unlocked fairly early on.

Being able to lower or completely eliminate having bad debt and having a financial buffer are two hugely impacting benefits that can be obtained well in advance of even getting a third of the way toward achieving FI. The removing of a lot of the worries and others negative emotions that can exist when having debts hanging over you, and in not having money available for unexpected outgoings is awesome.

The next level of increased peace of mind comes from having such a big financial buffer that this buffer turns into FU Money. This helps in giving you the warm fuzzy feeling of not having to stand an awful job for the fear of not being able to cope financially in the interim, it allows you to speak your mind a little more freely as living month to month is now so far back in your rear view window. It allows you take take more risk, possibly to even start your own business or perhaps to consider a different career. Doing these such things from the position of FU is far easier and options available become far greater. The possessions of a large financial buffer also means there is much less immediate impact from a job loss triggered from redundancy or ill health.

Scoring attributes

Financial Buffer, Low or no debt, Less Job-loss impact, FU Money

Increased Abundance

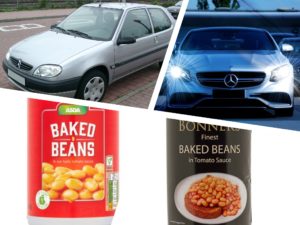

When it comes to the impact of healthy finances and in particular a good flow of money being available to spend – The increased level of abundance that can be obtained is a huge benefit. Life can already provide much abundance of course and often times much of this can be free and relatively cheap no doubt. It however is also true that there is increased options and choice available when there is more money at hand. This can help add more food and drink to the buffet table of life so to speak. This can be in the form of increased travel and holidays, expensive purchases that can then provide on-going experiential happiness going forward such as buying an iPad, ps5, new guitar etc. There can be more disposable income which can allow you not to sweat over frequently gifting things to people, eating out, going on weekends away etc. This all helps to lubricate life in a positive way.

Scoring attributes

Holidays abroad, Multiple weekends away, Good disposable income (multiple activities), Everything designer Label, Big ad-hoc expensive purchases, Frequent Gifting, Frequent big expensive purchases, Amsterdam every month

Early retirement possibility

Now we get to discuss one of the major elements and goals of Financial Independence for most people involved in the pursuit – the ability of course to retire early. As readers will be aware, there are many different attitudes and goals within the FI scene and some people will simply aim to retire as early as possible whilst others may be pursuing just the ability to retire if so desired. I certainly now fall into the latter camp although originally I was firmly entrenched in the first.

For me, the huge benefit when it comes to early retirement goals is the ability to be in a sense early retirement ready. Work in older age can become completely voluntary and along the journey, there can be a sense of progressing along a scale of working also becoming more voluntary the closer and closer you get to being able to retire early. This feeling and situation certainly makes work stress feel less of an issue in my experience. The other main benefit of course relating to pulling the trigger on early retirement is the increased freedom of time. You can then choose to free up time by stopping working early but still have the option to carry on if you feel the time spent at work is still valuable and enjoyed.

Scoring attributes

Voluntary work in old age, Early retirement, More freedom of time

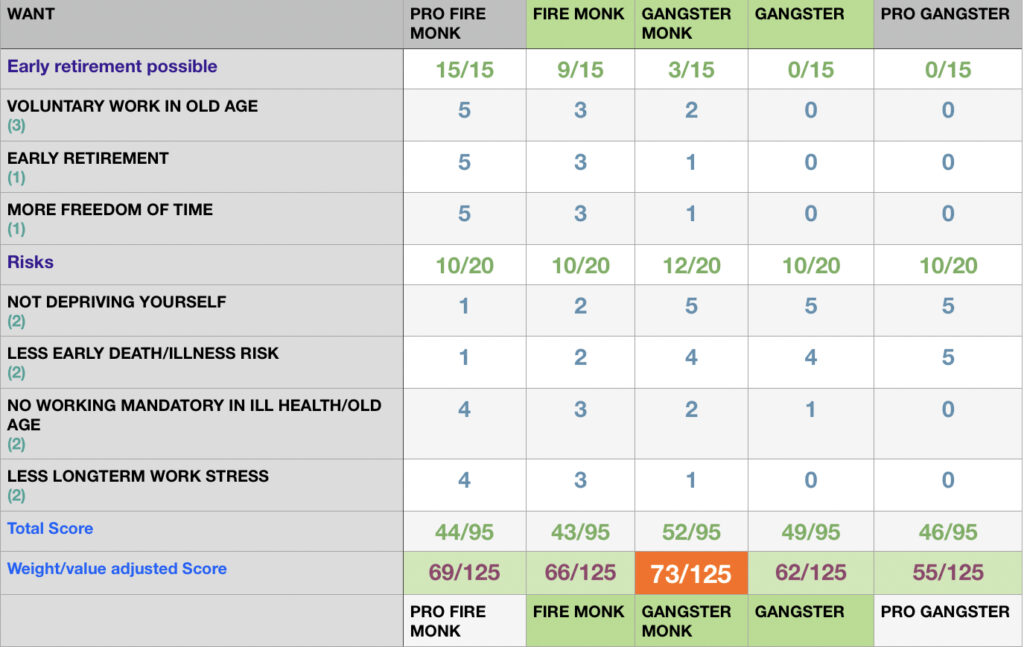

Risks

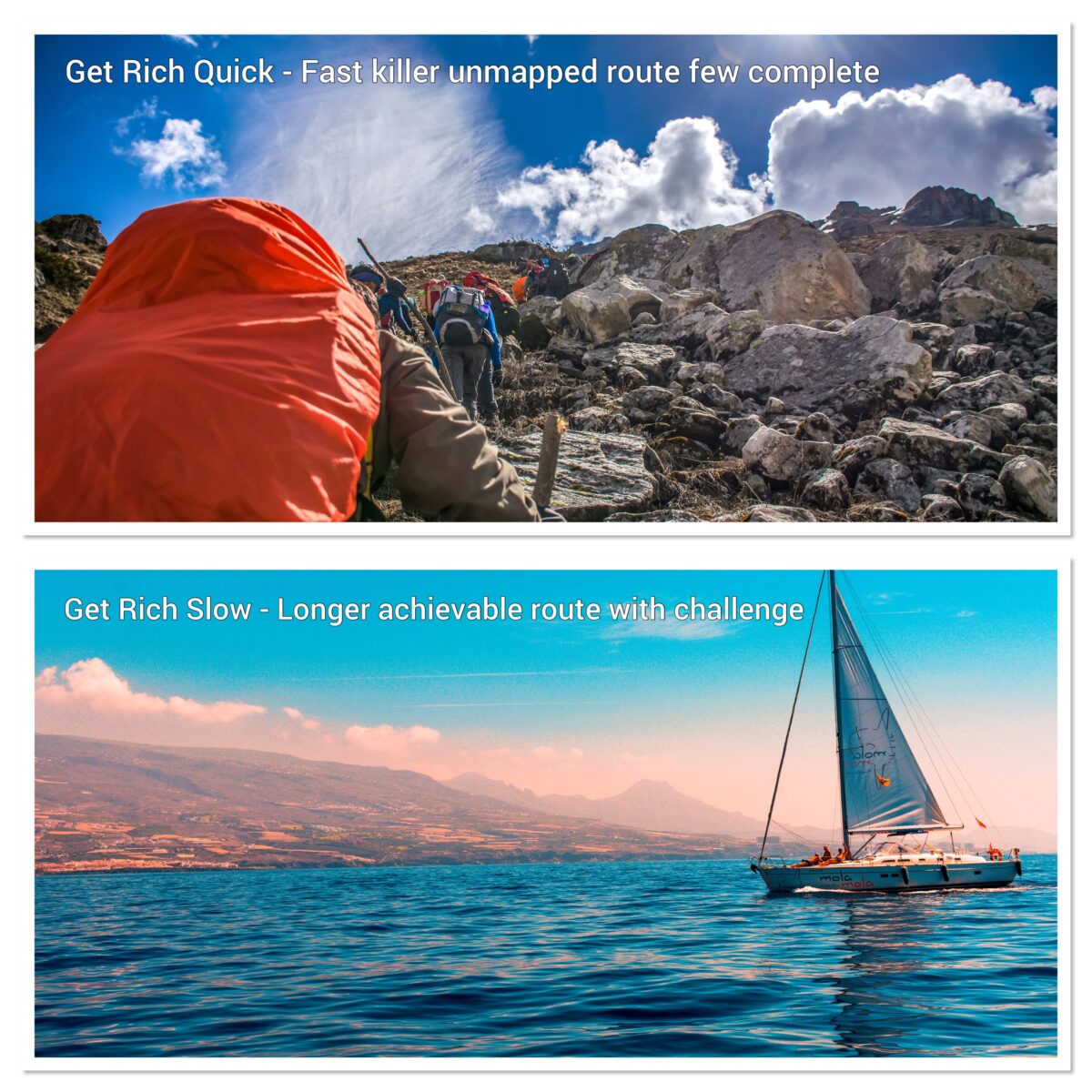

When it comes to working towards financial independence. There can sometimes be risks of having the pursuit rise above all else. It can be possible to pursue it from the perspective of fully admitting that you are delaying happiness now and depriving yourself to an extent for future predicted happiness. This can be done by investing every last penny and forgoing things in the here and now. The risks with doing this could be that you will never actually see your idilic version of early retirement or that when you get there, your health may not allow you to enjoy it as fully as you had hoped. There is also of course the opposite risk of not being able to retire early and due to this, you may need to work in a job you dislike for a long time and perhaps even during some period of chronic Ill health where working could make your illness even worse – work becomes pretty much forced.

Scoring attributes

Depriving yourself, Early death/illness risk, Working mandatory during Ill health/old age, Longterm work stress

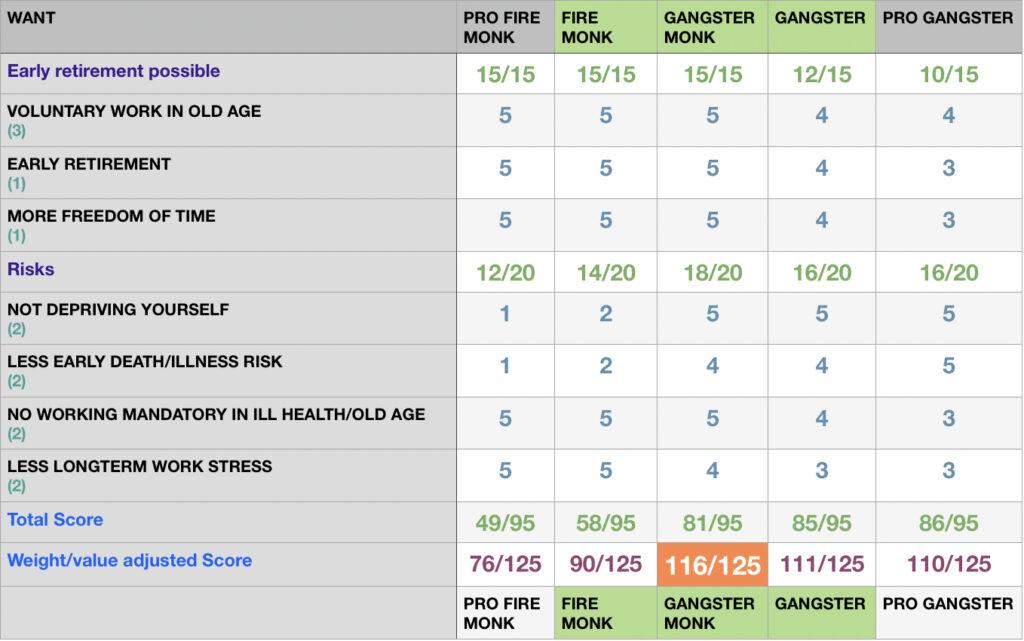

Strategy Review Scoring (Age 35 – Mortgage free, £250,000 Portfolio – Main job with a side hustle)

Now that I have detailed some of the most important themes and attributes of why financial circumstances and seeking financial independence matter to me, I will now look at reviewing the strategies against these.

Points awarded are out of 5, with 5 being the best and 0 the worst

(N) This equals the weight of the score so if this is two then the points will be doubled

FI strategy at 35 Post Project 2235 – And the winner is…

Gangster Monk

Using the scoring adjusted for weighting based on importance to me, I can see that the middle path of the gangster monk gives me the biggest bang for buck on life happiness. This strategy would result in me taking around 3 years longer to reach FI however when balancing for risks and considering in turn focussing on happiness both in the now and later, it should result in more happiness when spread over the 12 years it would take to actually achieve financial independence. This really does confirm my gut feeling choice which would have been somewhere between FIRE Monk and Gangster Monk. I already have so many of the benefits at this stage of my journey towards FI that delaying my actual fully FI ready date by just over 4 years would not actually matter to me as I know I’d likely be happier along the way.

What if I was starting from fresh?

As described in the introduction, I thought it would be interesting to see whether my choice of path was influenced more by my current position of being mortgage free and having a large portfolio to begin with and if I would choose the same path if starting again. I have chosen age 30 as this might be a typical age to start after getting to a decent salary and perhaps paying off some debt etc. I could of easily have been in this situation myself if it wasn’t for fortunate circumstances and the discovery of FI. I have adjusted the investments and weekly disposable figures slightly due to having £700 less income due to now having to pay for a mortgage. These however still reflect the broad ratio of my first scenario figures.

Age 30 (Mortgage monthly £700 payment, £0 Portfolio at start)

Main job with a side hustle (same income as now)

Strategy Review Scoring – Age 30 (Starting from fresh)

Points awarded are out of 5, with 5 being the best and 0 the worst

(N) This equals the weight of the score so if this is two then the points will be doubled

FI strategy at 30 (£0 Portfolio with a Mortgage) – And the winner is…

Gangster Monk

This result is very interesting to me as if I were in this position and I was starting from scratch, I would value more of the benefits along the way it would seem than actually being able to retire very early. All of these options barring the Pro Gangster and Pro Monk approach would likely have to involve a bridging period in order to be able to retire decently early. This would mean my eventual post FI income figure may need to rely and come more from my pension income than is with my current actual position. In that option I am planning to use my state and private pensions more as contingency and safety nets in the worse case scenario where my FI Pot was depleted. These would provide more of a basic income. This has always given extra peace of mind and is done for similar reasons when preferring to own my home outright mortgage free.

I do know that this option will also include the fact that during the latter years of this strategy, I may no longer be paying the mortgage and also that there would of course be room for possible job promotions etc but for simplicity and due to this matching with my current circumstances barring the highlighted differences, I have no intentions right now of working for higher management roles or changing my job for higher pay. I like to imagine that in this imagined scenario, I am also doing the same exact job where I am happy in my role and company.

Conclusion

Well… it really does seem as though I am going to be leaning more towards the gangster monk strategy going forward. This will mean that my investments each month will be close to halved and I will be in effect delaying being Early retirement ready by 3 years. I feel though that this is completely worth it due to the benefits in happiness along the journey itself and also to mitigate some of the risks of depriving yourself and of possibly not being able to see this proposed better future life, especially when you have deprived yourself along the way to reach it.

When looking at the strategy if I were to hypothetically start this again without some good fortune that I had along the way, I am further more made to feel very grateful to my current circumstance. I would though in this imagined scenario still strive fully towards financial independence. I would in turn pick up some of the benefits very quickly towards the start of the journey and would still live life well now, I would live for both now and tomorrow. The longer length to achieve FI might indeed mean I would have to create a bridge between my FI Pot and pension money to retire in my early 50s however the fact early retirement would still be an option would still be incredible. I would still be a gangster monk. 😅

As always, Love to hear your thoughts, TFJ.