Hey everyone. Hope you are all doing well :).

It’s time for a new ambitious but hopefully achievable future target. My last post celebrated reaching the Base FI milestone of £250,000. This achievement had long been a dream goal of mine and actually in fact used to be my original FI target back when I was a little naive of what I really needed to consider myself as Financially independent.

The New Target – Financial Independence in 10 Years

As some may have already guessed by the blog post title… My new Target is to achieve Financial Independence within the next 10 years. So to be clear, let’s define what I need to achieve to consider myself to be Financially Independent followed with some details around the phases.

What’s required?

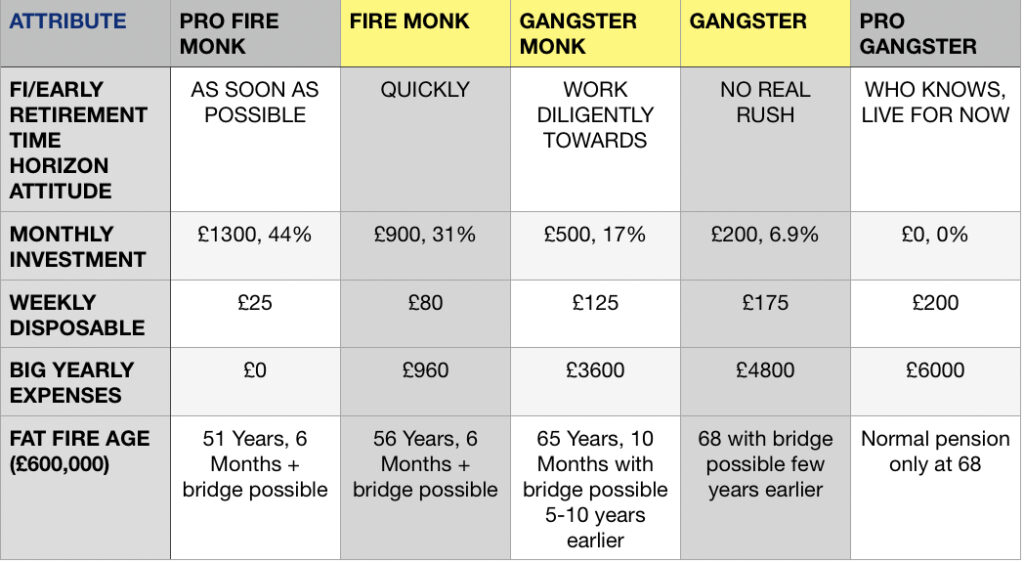

I require £2000 per month to be able to fund my Life at FI which is the same amount that I am using now whilst being on the building part of the journey itself.

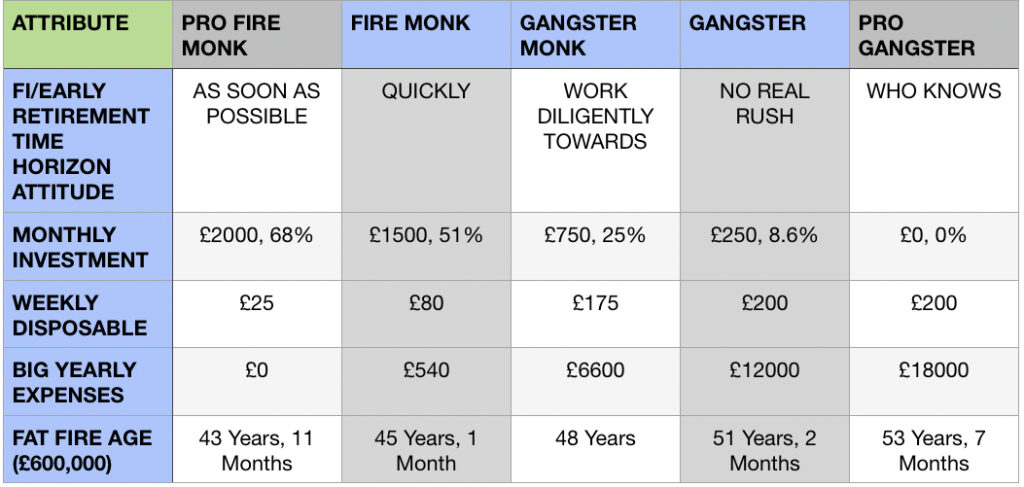

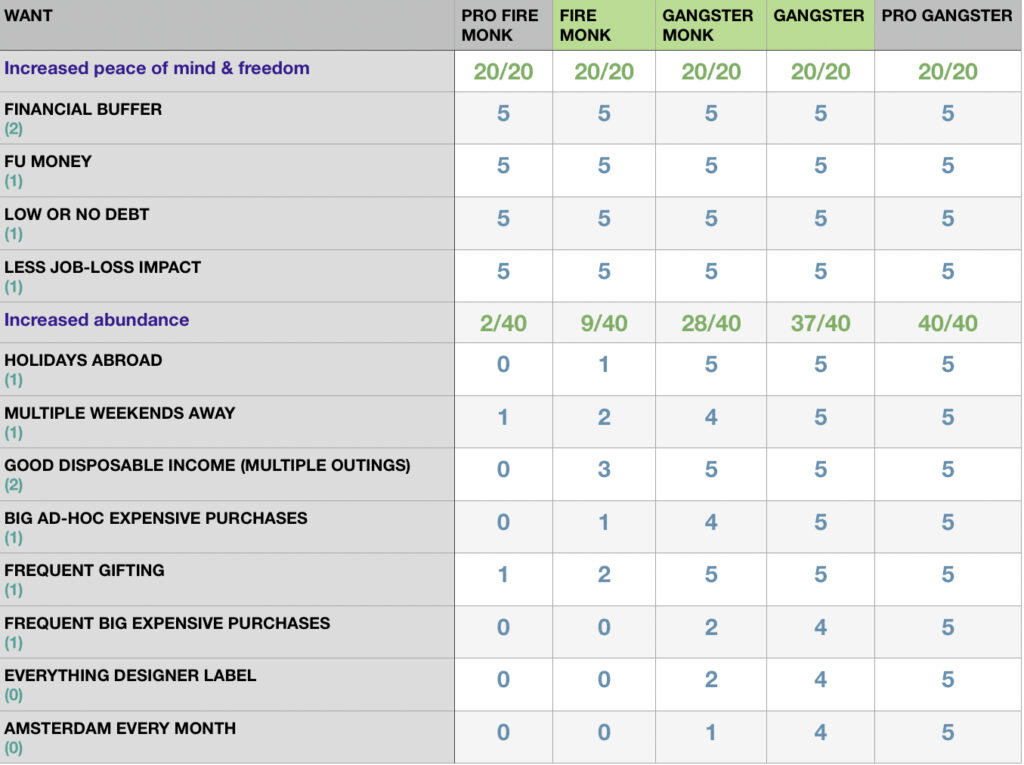

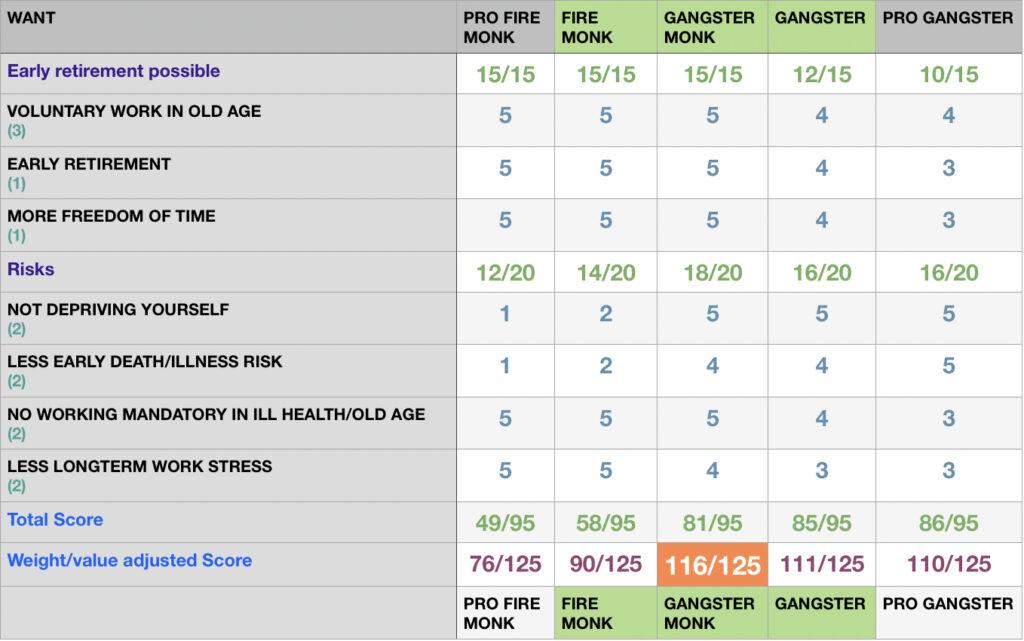

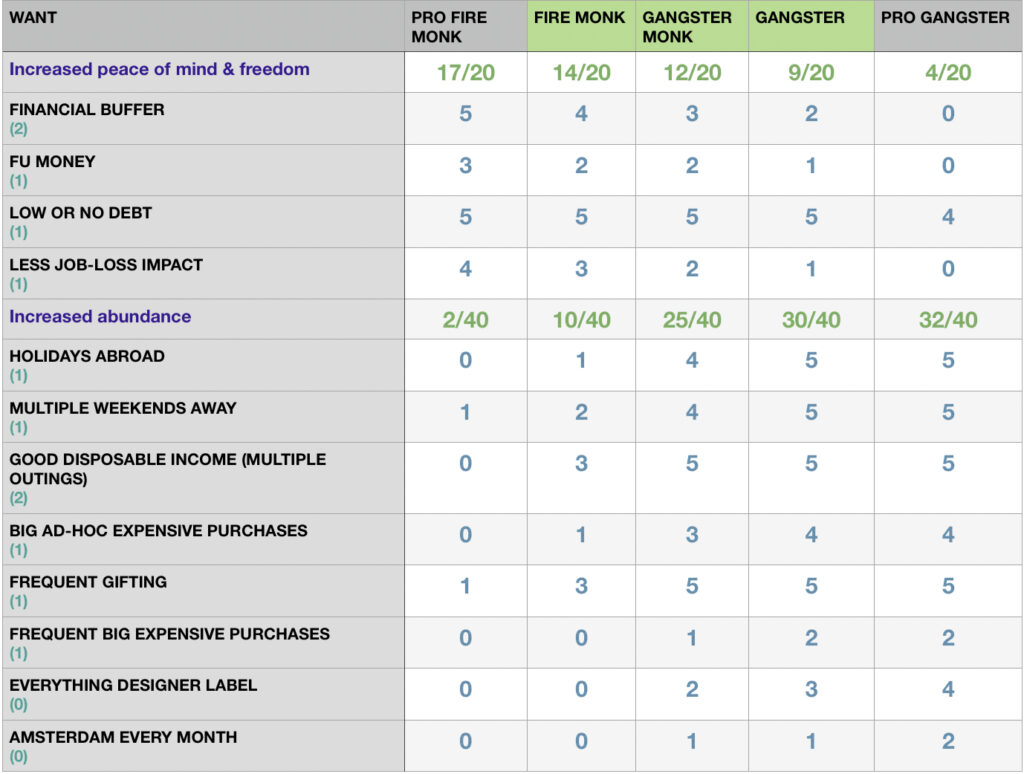

This affords me to live a Gangster Monk lifestyle that I feel achieves a healthy balance of spending money in all the right ways to thrive without any deprivation being felt along the way. This also affords me a healthy buffer that I can use should I wish to draw less money during the bridging phase if there are any large sustained market falls etc.

How will I achieve this?

I aim to reach this £2000 per month in two separate Post FI phases. The first phase will make use of a bridging fund followed by a more guaranteed safety net of public pensions at State pension age. This will give me more confidence and peace of mind when using the bridging fund for 21 years knowing that there should be no chance of money running out in much later life.

£600,000 Portfolio in a S&S ISA (Bridging fund) – Age 47 – 68

- This assumes 5% growth across the 10 years and 3% is left for the inflation difference

- This assumes a 4% SWR of £24,000 Tax free giving £2,000 per month

- This requires average monthly investments of £1200 over 10 years

Public Pensions (State & Public Job) – £2000 per month – Age 68+

- These pensions combined provide £2000 per month after tax and are inflation linked and not reliant on the 4% SWR rule

- These pensions only become available at state pension age which is currently at 68 years old for me

- This assumes remaining in my current Public sector job for another 10 years

- This assumes paying National Insurance contributions for another 10 years and then manually paying voluntary contributions for a further five years one year at a time to get the full state pension

The FI Journey Phases

The 10 Year Build Phase Journey

One of the parts of the Journey towards Financial Independence that sometimes gets overlooked both in terms of focus and importance is the building/accumulation phase. There can be a lot of focus on and looking forward to of the destination alone which is of course understandable. I have written about this before and in summary, I think people can want to almost rush the journey a little too much. I think this is a mistake and especially so when the timeline is a very long one.

What’s important to me is that the next 10 years are great in their own respect. I don’t want to rush towards older age nor rush towards something that is not even guaranteed to come. I want to live for now and to live for tomorrow, I want to have balance and be that Gangster Monk that I set my sights on previously! Below lists ways in which I hope to achieve this said balance and joy:

- Working a job that I mostly enjoy, I will not stand for a job that gives me misery for a decade

- Having enough money for life’s emergencies and for those expected unexpected outgoings

- Having enough disposable income that acts as a good lubricant to enable life’s pleasures

- Having money to pay for ad-hoc Big expenses such as big Holidays, regular weekends away, a new Phone or TV as and when I need them

- Investing an amount that’s realistic given the previous requirements

- I want to look forward to tomorrow, this weekend, this summer and the next big holiday all whilst feeling privileged to be on a path to achieve Financial Independence in my late 40s. I can look forward to this of course as well, but only whilst not being in such a desperate rush to get there.

Bridging Phase Journey

This marks the point where I will actually consider myself to be Financial Independent. I will have built up enough funds to cover £2000 for 21 years using the 4% SWR rule knowing that I can scale back some spending if I needed too. I will also have built up enough of my public pensions to provide £2000 at State pension age. I want to ensure the following during this phase:

- I can continue to work if I choose to, I may carry on working until 50 which was my most recent target age for FI. I might drop to part time work or do some contracting or consulting. The main thing is that what I choose to do becomes completely optional. I might even decide to play games all day on the PlayStation 7!

- Having enough money for life’s emergencies and for those expected unexpected outgoings

- Having enough disposable income that acts as a good lubricant to enable life’s pleasures

- Having money to pay for ad-hoc Big expenses such as big Holidays, regular weekends away, a new Phone or TV as and when I need them

- There is ample buffer for peace of mind and less concern for whether 4% SWR will hold up perfectly

- There is less concern of money running out in later life due to the safety net of the public pensions that are not linked to any investments and that rise with inflation.

- The reality of likely inheritance money appearing at some point also lowers any fears with regards to not having enough money in older age

Public Pensions Phase Journey

When I look into the older age phase of my life. The stand out feature is that I will have a safety net of my public pensions to provide my continued £2000 a month. There is of course the good chance that I may also still have a fair amount of my bridging fund left available. I think all the previous bullet points still apply to this phase however choosing to work still is perhaps far less likely but of course is not ruled out entirely as if it didn’t feel like work, was part time and gave me joy. I could still of course do it – I just think it’s less likely.

20 Year Journey to Financial Independence – The Half way line

It struck me as I was thinking about this target in more depth that it had taken me 10 years from starting on the journey back in 2014 to reaching the £250,000 milestone. It is now possibly with some effort and another fair wind going to take a further 10 years to truly be Financial independent with this new target of mine. This would mean the entire journey from start to end would have taken 20 years. This seems quite apt and I would be absolutely thrilled if I ended up achieving Financial Independence from start to end in 20 years!

I think the main take away for myself when planning these future FI Journey phases of my life is that I want to look forward to all of them and will not race to the completion of any. We all know what comes at the end of the journey! Long live the FI Journey…

As always, thanks for reading if you got this far. I would love to know what you think of this target. Is it reasonable, am I missing anything?

TFJ