Hey everyone. Hope you are all doing well and that you are starting to slowly but safely enjoy more freedoms now we are coming out of a full lockdown. Have fun irreversibly raising that pint just as Boris has…

What follows is a post that is rather finance review focussed with this being a FY End update post and all. As always though I will provide a personal and work update too. Let’s start with reviewing my current finances at the end of FY 20/21.

Financial Year End 2020/21 Review

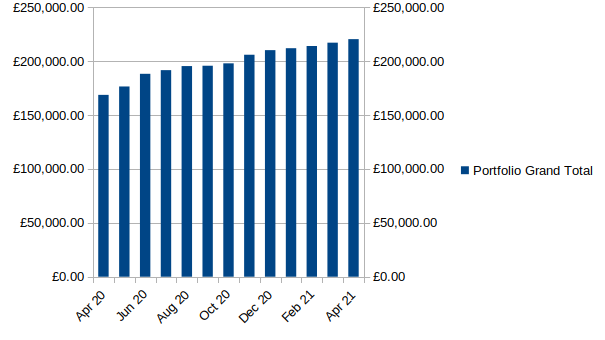

Well, this has been the year of COVID and due to this, there was a huge crash followed by a huge rally. I lost £27,000 at one point which really did test my nerve in this game of FI. I passed the test for sure as I didn’t sell and I kept on investing as per normal. I am very very pleased that I did.

Financial Update – April FY End 2021

The below figures are taken from 25th April.

- Monthly investment (Jan 21 to Apr 21) – £1500 each month

- Savings rate (Jan 21 – Apr 21)– 55% each month

- Investment portfolio – £206,975.18

- Cash is king fund – £10,000

- Emergency fund – £1002.89

- Big expenses / holiday fund – £2448.62

Total Liquid Funds = £220,426.69

Price difference from Predicted to Actual Finances (Late Dec 20 to April 21 = -£3.28

As I track my expenses to the penny, when it comes to reviewing my finances more in depth twice yearly at FY and Calendar Year Ends, I do a check to see how accurate my predicted finance portfolio is compared to reality. There is always a chance I have missed the odd coffee, gift or any random expense or of course simply have added things up wrong.

It turns out that I was only £3.28 down which I am happy with. It was actually £4.28 at first but then I found a pound coin when I was cleaning out my car 😀. I won’t fret over this loss that’s for sure.

FY End 2020 to FY End 2021 Comparison:

End of FY End 2020 = £169,347.41

End of FY End 2021 = £220,426.69

Increase = £51,079.28

Calendar year End 2020 to FY YE 2021 Comparison:

End of 2020 Calendar Year = £210,056.25

End of FY End 2021 = £220,426.69

Increase = £10,370.44

I am absolutely thrilled my Portfolio is as high as it is. It feels so close to that quarter of a million Base FI target of mine that I can almost taste it…and it tastes darn good. The £51k large increase year to year is partly down to the portfolio dropping substantially right at the end of last FY20/21 but still with what’s going on in the world, I am still shocked it’s recovered so well and so fast, surely a crash is coming? Yeah well if there is or isn’t, I can’t pretend to be able to predict such things. I will carry on investing and holding (Diamond hands💎 in a good rational way).

Spending Review – My expenses

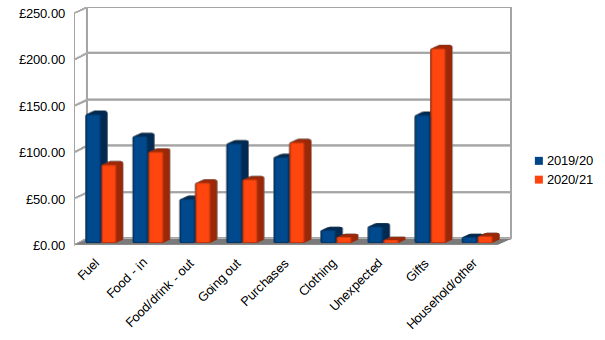

I thought It would be good to do a mini spending review to show how some of my monthly outgoings have changed from last FY pre COVID to this FY just gone.

Monthly Average Outgoings – Select Categories

A lot of this change in spending makes sense with this last year being the COVID lockdown year. I have spent much less on fuel but perhaps not as less as some as I still have had to go into the office a couple days of the week. I have spent more money on takeaway and alcohol which is the food/drink out category whilst spending less money on going out. Most of the spend for going out was done in the summer to early autumn when things were much better and you could actually in fact legally go out.

I have saved money due to COVID in some categories but because my gift category outgoings has increased a fair bit along with smaller increases in food/drink out and purchases categories, this has resulted in balancing out my spending broadly speaking to be the same from year to year.

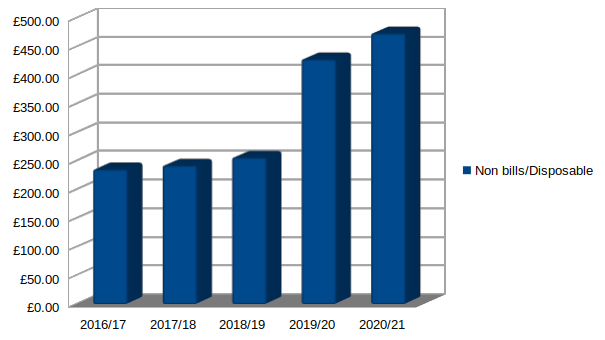

Disposable / Non bills monthly spending Average

I thought I would include a chart showing my disposable/non-bills average monthly spend over the last 5 years. You can see how the last 2 years have seen a big jump on the previous three. This is mostly due to me loosening up a bit and spending more money on going away on more weekend trips and just spending more money in general on activities and gifts. This has certainly been money well spent for me and I won’t be changing this any time soon.

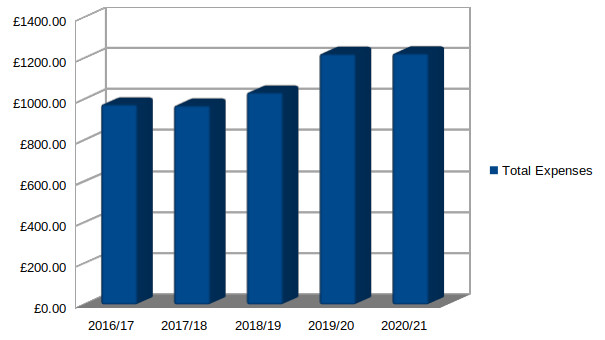

Total Expenses monthly spending Average

Building on the last few charts, you can see how the last 2 years have seen an increase in my monthly spendings and how even with COVID happening, my overall expenses have remained pretty much the same. I am starting to confidently now think I have hit a sweet spot in my spending where any question of depriving myself whilst on the journey has certainly been quashed for now.

Post 2235 Project Thinking

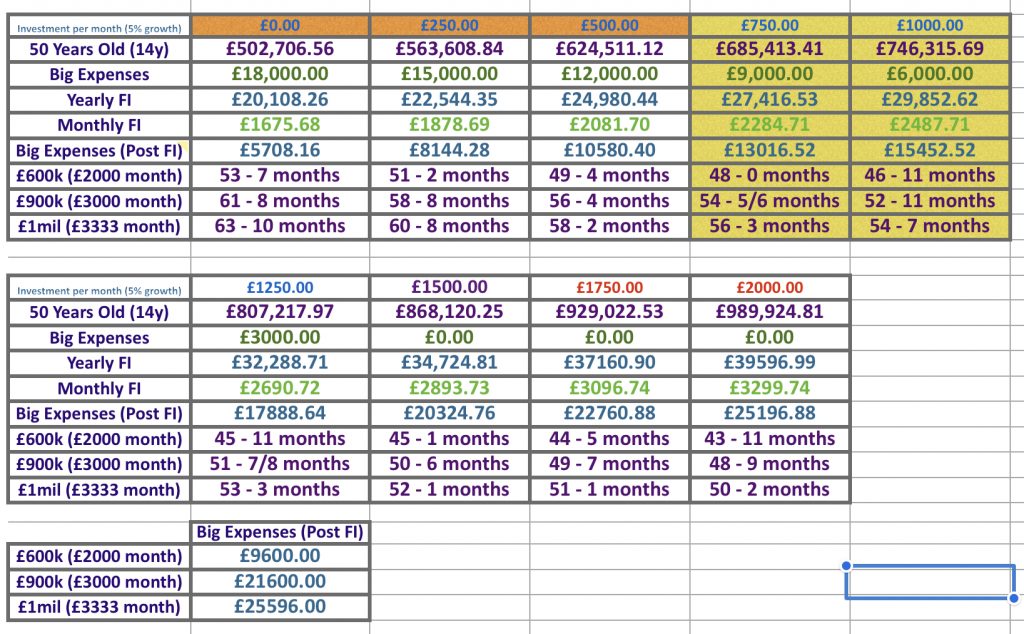

In my last few update posts, I have had some musings on Post Project 2235 and this post is no different. I wanted to update you with my latest spreadsheet contents to show my further thinking on this:

I have added extra details on how long it would take me to reach £600k which I consider to be my main FIRE number whilst also adding rockstar levels of £900k and £1,000,000 FIRE 🔥. I have also noted down how much money I would have left for Big expenses spending each year at these amounts. This is on top of £1200 that is reserved for Bills/Disposable income which matches what I spend now which is where I feel comfortable at.

To recap on Post Project 2235, I currently invest £1500 a month and aim to reach £250,000 in Dec 2022 (formally known as Project 2235). After this time, I now intend to lower my investing from between £500 to £750 so that I can have my Big expenses fund topped up so I can live well along the journey. I want to fully enjoy the next 14 years so there has to be some extra money which I will also put towards doing my house up inside as well as for annual holidays and buying the odd iPad Pro etc.

I have previously used matched betting winnings to secure this big expenses income but I have no interest in that anymore and unless there is a very very low risk, low effort way of earning the extra £500 a month then I don’t think I am interested. This also goes for pursuing a new promotion with more stress and pressure or simply getting a second job (technically third as I still have a 2nd semi permanent side hustle). I have to balance the cost of being possibly less happy at work, losing more personal time if I got a third job versus how long extra I will have to work if I invest less each month.

If I invest £500 less each month for example then this will give me £6000 big expenses money each year but will mean instead of hitting £600k at 45 years old and 1 month, I will hit it 1 year and 10 months later at 46 years old and 11 months. Now to be honest, if I can secure £6,000 a year without then needing to get promoted to a job I hate more (likely be management level where I am now) or changing jobs entirely (I really like my current job) then delaying FIRE by nearly 2 years would be worth it if the quality of those 11-12 years was far higher. This is even less of an issue when my plan is to try to work until at least 50 so I can secure a state and public service pension of £24k equivalent (£600k FIRE) as a backup or so I can use my actual £600k FIRE as a bridge into that, it helps me sleep better at night for sure.

With this in mind, if I invested £750 less each month which meant reducing investing by half then I would get £9,000 a year for big expenses which would match my £9,600 post FIRE big expenses amount which would mean I know the money I live on is the same before and after I FIRE, no deprivation at all. I would reach £600k at 48 and then work another 2 years to get my more guaranteed £600k backup FI.

I have not settled on any of this yet, I know so much could change all these plans and I am fully aware of that but it’s really fun to think about none the less 😁…

Personal & Work

And finally, a brief personal and work update. So what have I been doing? Well, things are starting to open up a bit now but really I won’t be going properly out until May 17th when you can go to pubs and restaurants and so many other places in doors. I have visited a few friends out doors but that’s about it, oh I also have been to a shopping retail park.

I have had to delay my Amsterdam trip for the third time now to September as this was planned for May 17th but you can’t currently travel to the Netherlands and with that country likely to be amber rated it’s just not worth it even if we allow travel and they do by then. I had to pay the difference in new airline and hotel rates but it only cost an extra £90 so can’t complain too much.

I have lost 6 pounds in 3 weeks as part of a six week plan to get back to my ideal weight before May 17th. I have done really well with this so far, only Fat Friday exists where I eat more and drink as well but otherwise being I am being very healthy with what I eat and also I am working out daily still at home.

As for work, things are very busy lately and I am still in the office twice a week, sometimes three and then home the other days on a rota. I am still liking this arrangement as I find it’s the perfect balance for me. The hospital is in a much better place right now thankfully, the lockdown and very successful vaccine rollout thus far has changed things so much for the better and we have very few COVID patients now and are resuming normal services.

I would love to hear from you all, let me know what you thought of this post and what you have been up to, any trips to beer gardens?

TFJ