Hey all, I hope everyone is keeping well. It’s that time again where a blog post update is due!

Financial Bear Market Update

Financial Update – Early July 2022

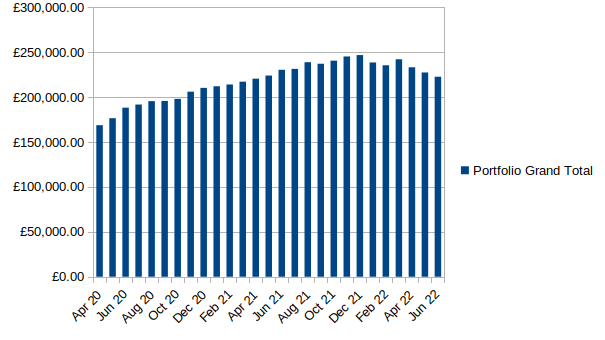

The below figures are taken from the 9th of July.

- Monthly investment (Mar 22 to Jun 22) – £1500 each month

- Savings rate (Mar 22 – Jun 22)– 55% average each month

- Investment portfolio – £225,836.18

- Cash is king fund – £1500

- Crypto Punt – £0 (classing this as £0 despite being around £400)

- Emergency fund – £100

- Big expenses / holiday fund – £500

Total Liquid Funds = £228,436.18

As you can see from the graph above, my portfolio has taken its biggest dive since the Covid pandemic. As similar to then though, as much as I of course don’t like seeing it go down – I am not too bothered as I know so many other people are genuinely suffering from energy prices rises, fuel increases and general inflation across the board. Peoples pensions that are stock market invested (the majority) are also suffering so there is a sense of collective suffering and not that it’s just me, that makes it far more bearable. If this gets far worse and it continues to create anything similar to 2008 then my ability to retire early might be pushed back a few years. That is not exactly a genuine sob story I can tell to anyone is it?

I have marked my crypto investment as £0 more as a psychological weight lifting mechanism as during the recent crash, I decided that I had pretty much lost my punt investment and anything that was still there or if it ever bounced back would purely be a bonus. You can also see my cash is king and big expenses fund are both much lower than before and that’s because of a large unexpected outgoing I will talk about in detail later on.

I must admit that every time it comes round to investing monthly now, I really do feel like I am getting cheap prices so to speak. I feel like DCA (dollar cost averaging) is working it’s charm. I won’t need it to reach the same high to make the money back in the future. I am essentially buying the dip and lowering my average cost which is a very crypto/Wall street bets type of saying but when it applies to investing in the world economy as a whole, I am very confident it will indeed rise again (if it doesn’t, we are all buggered!). If I chose to invest in certain sectors only, individual stocks or things such as crypto then I feel I have no guarantee at all it will bounce back and even worse, I could be feeling pain when something crashes but it would have no impact on the majority of people – If Dogecoin crashed for example and I had my life savings in it, most would be unaffected but my life would be turned upside down…I think that my investing approach has again been justified and validated for myself personally similar to like it did the last time when Covid caused a crash.

How is rising prices affecting me? My fuel bills are rising and this is noticeable due to having to now be in the office three days a week instead of two. It would be even more painful if they changed this to five but for now it will remain at three thankfully. My energy plan has recently changed to the new price cap as I was on a year fixed package. This has caused my unit rate has to more than double for both gas and electric but due to it being the summer, I haven’t noticed this much yet but the winter will be interesting. A lot of the food and drink I buy seems to be mostly the same price when deals are on but I have noticed a few things rise, I can certainly cope with it for now but I am sure it will get worse over the year. My other household bills have certainly risen but nothing too bad at the moment either. I am still finding my general outgoings are kept within budget but part of that is due to my food and fuel allowances still being higher than I have used over the last couple of years, the buffer is being eaten into but at the moment I am still in the green every month.

Holiday fun (Amsterdam trip)

It’s been postponed 4 times since I booked it in 2019 but I finally managed to have my holiday to Amsterdam in late May. It was superb! I think the long wait made it even better and the fact that there was no masks anywhere really – not in the airport, on the plane or anywhere in Amsterdam itself made it better as it was the first 100% normal holiday I have been on since 2019.

We went to the Ann frank museum, had a day out in Rotterdam where we also went to the zoo, went on a night time canal cruise, saw a medieval dungeon live show and spent loads of time being very very chilled out so to speak :D. It was really what we both needed. The weather was very mixed but that really didn’t bother us, we aren’t sun worshippers by any stretch of the imagination and usually prefer city type breaks full of activities rather than just tanning ourselves on a beach somewhere hot.

Despite me going to Amsterdam around 8 times now, this was only the second time with my partner as the other times were lad holidays. We did lots of new things we hadn’t done before including window shopping in all the malls we had never seen before, exploring random canals and roads we had not been down and also had one night drinking instead of chilling…it was very expensive to get drunk so I was glad we only did that the one night. We found cheap local supermarkets that the locals tend to use that were a bit further out in the sticks and had the best chips I have ever tasted with a sweet curry sauce that was simply to die for…Amsterdam 9 here we come!

Large Unexpected Outgoings category (Sad Pet Situation)

So after having a wonderful holiday away in Amsterdam. I came back to a sad situation with my pet cat which is at the time of writing still on-going. I had asked my next door neighbour to feed him whilst we were away. He has a chip on his collar which lets him in and out of the cat flap so he is free to go outside. When I got back home, I noticed a letter on my kitchen table which said that unfortunately whilst I was away he had lost his collar and had been outside for 3 days, my neighbour had fed him but he wouldn’t let her near him to put his collar back on. I wish she would have told me as I could have just said to take the batteries out the cat flap and it would then fail open so he could go in and out without the chip. This of course was only slightly annoying as he had eaten as she put food out the back garden and a cat can certainly survive being outside for three days so that didn’t bother me too much.

The next day when I woke up, I noticed that he was circling a fair bit before he sat down, more than normal. When I was downstairs and saw him more clearly I could see he was going round in circles most the time and his one eye didn’t look right. I called the vets immediately and was told to take him straight away. They did a physical examination and could not find anything wrong physically but suspected a neurological problem and gave him some steroids and a neurological pain medicine. They then referred him to another vet that had specialists in neurology.

Prior to going to the new specialist vets, I was informed that if I wanted to have a full investigation into his issue which would include a physical examination and an MRI scan that this would cost around £3500. I couldn’t believe how expensive this was but after research it seemed like it was the going rate. He was getting worse and we didn’t really have a diagnosis for him so I felt I had to pay for the scan to find out what we were dealing with to at least give him a fighting chance at recovery and to simply find out why he was becoming so poorly as I needed to know. He is 14 years old by the way. I was frustrated with how expensive it was but I knew I would pay the money as he means so much to me. I’ve had him as a companion for almost half my conscious life.

The diagnosis was that there was a brain stem lesion that is more likely to be an abscess caused by infection than a tumour although a tumour is also a possibility that has not been ruled out. With the amount of inflammation, a defined outer edge to the lesion, how quickly symptoms showed up and the fact he was outside for three days, the diagnosis of an abscess was given with the information available to us. He has since as a result been given high strength antibiotics. His walking has somewhat improved but he has since been unable to eat properly and can only lick food so I have been giving him gourmet paste cat food mixed with water which he loves. It can take months for the antibiotics to penetrate the brain stem fully so I currently don’t know how things will turn out, there is certainly a chance that this could still be a tumour as well but there is at least some small hope he could recover as even if this is not a tumour, a brain abscess is fairly deadly on its own. Surgery was ruled out because it would damage the brain stem in the process and was far more risky to do, not to mention that this would cost northward of £8000.

To bring this back to finances a little more, I don’t have a £3500 unexpected outgoings fund. I only give myself £1000 a year for unexpected large bills. This kind of unexpected cost has never occurred up until now and it just shows that such large outgoings do happen from time to time. It could happen again in terms of a huge car bill, house repair or other such expense. Now I was fortunate because I had a Cash is King fund where I had £5000. I have had to raid this but this has saved me from selling any investments during a period where that’s the last thing I want to be doing, it has also saved me from investing less each month in order to cover the costs. I am certainly grateful for that fund and it makes me want to keep it going forward.

I looked into how much I might have been better off if I had pet insurance for him from a kitten. It turned out that with all the premiums and having to co-pay 20% due to him being over 10 years old. I would have paid around £3300 anyway even if I had insurance which made me feel a bit better about not having it. When the neurologist vet originally asked me about my pet insurance and I said I didn’t have any, they said – ‘oh dear’.

For the first time in years, I haven’t been able to invest my monthly amount of money before I get paid if I wanted to. I have had to actually make sure I have enough money in the bank. I haven’t been able to borrow from myself so to speak or use my own interest free overdraft as I have been far closer to £0 after all my bills and disposable income have gone out. This has felt very strange to say the least as for the first time in 8 years – when I get paid actually really matters. I am more conscious of my pay day. I am now gradually trying to build up my cash again by saving a bit more each month by not spending as much on going out and buying stuff. I need to slowly get back a healthy buffer even if it won’t be as big as before. I need to shield myself as much as possible from failing my Project 2235 and this will only fail if I don’t continue invest £1500 each month or if I have to sell any of my investments.

I think it’s important to say that I have no regrets in the slightest over spending this £3500. Even though it did annoy me, I didn’t question it. Paying the £8000 to have surgery may have gave me pause for thought depending on the likelihood of success but thankfully that decision was already made for me.

Thanks for reading my post if you got this far, I appreciate it as always. Would love to hear your thoughts and how you’ve all been getting on.

TFJ

Nice update and hope all goes well for the cat. My friends who have cats pay a huge amount of pet insurance but they’re unlikely to have pots of cash available to pay for emergenices like this, so need it. I think it’s been around 20 years since I last visited Amsterdam – I’d love to go back. We visited the Anne Frank museum too back then! I think you writing off your crypto to zero is similar to me writing my property crowdinvesting investment to zero – I still have around £1.5k stuck in there, maybe I’ll get some… Read more »

Thanks for your comment weenie as always. Your crowd funding investment probably looks a lot more likely of coming back than my crypto one but who knows hehe.

We unfortunately had to have my cat put to sleep as a second MRI scan funded by the vets themselves showed that it was in fact a tumour. I miss him deeply.

TFJ

Sorry about your cat, good luck with his recovery. Our cat is 8 years old now and I’m really fearful of something like this as I know it’s inevitable. We don’t have insurance either, but I’m second guessing myself now as if we had a 5000+ bill, I don’t know if I’d have the heart to say no. It’s just so expensive as they approach and go over 10 years old… Here in the US they also have maximums which seem pretty low, so it almost seems pointless – insurance is for the super big bills in my opinion and… Read more »

Hey SavingNinja, Thanks for your post. It hasn’t made me question the decision entirely no as if I had paid for pet insurance from when I had him and then used the pet insurance for this then it would have only saved me £200. Having to have neurological interventions is very rare with cats so this will likely never happen again however if I had to have an operation that could have saved his life and that was even more, many thousands more possibly then this is where it would be right to have pet insurance. I think if I… Read more »