Hey all, I hope everyone is keeping well and that you are ready for the Christmas festivities to begin. It’s that time again where a blog post update is due and it’s certainly one I have been looking forward to writing!

Operation Project 2235

Just as a reminder, 3 years ago in the following post – I set myself the ambitious but I thought realistic challenge of investing £1500 a month for 3 years. This would amount to investing a total of £54,000 which would of seemed laughably impossible only a few years earlier. I had worked out through compound interest calculators that If I could invest this amount and I then assumed 5% growth over the next 3 years on average – I would be able to hopefully hit the magical milestone of a portfolio value totalling £250,000.

Success Criteria

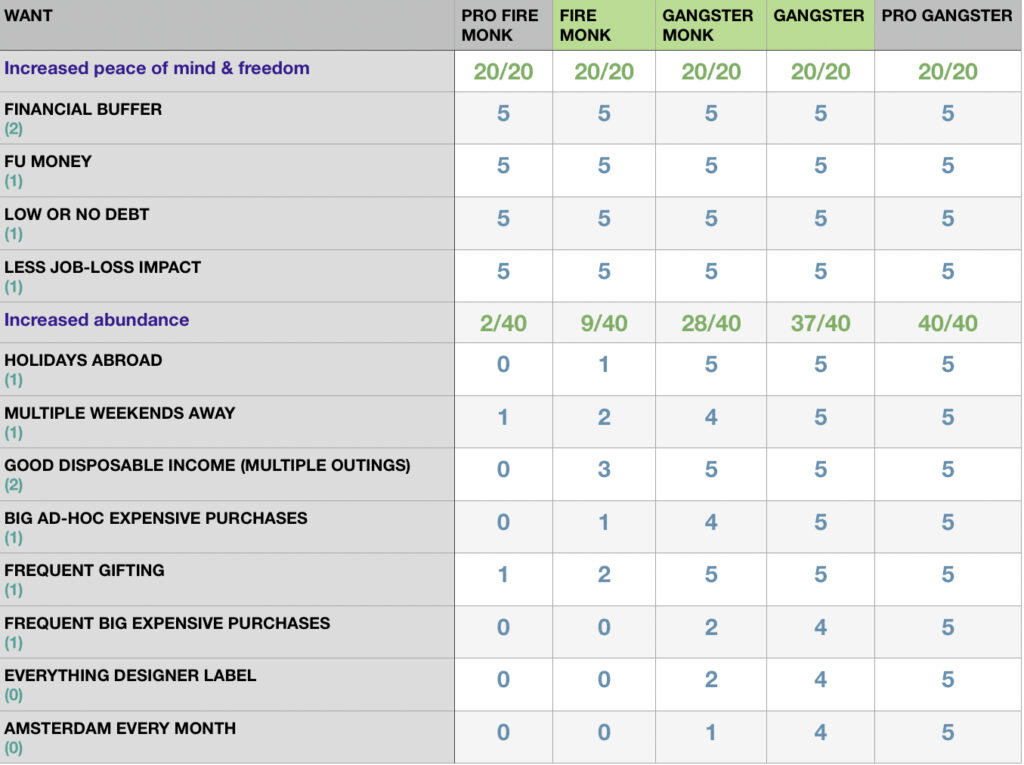

I set out for this challenge certain success criteria because it wasn’t just purely about saving the £1500 each month. It had to be done in a way that did not take the joy out of living during the three years by depriving myself and had to also be realistic so unexpected outgoings were assumed during these years and needed to be budgeted for. This would mean still having a cash buffer, unexpected outgoings fund, big expenses fund and enough disposable income each month to fund the merriment of life.

As for the £250,000 Target itself – this was going to only be possible with a supportive fair wind and indeed luck to an extent as there was no way to predict what the market would do over the short time horizon of 3 years especially after such a long bull run. I did not want to limit my perceived success of this goal to purely market conditions uncontrollable by me so I chose upfront not to make that number part of the success criteria.

So in summary, I had to:

- Invest £54000 over the next 3 years (£1500 a month)

- Not deprive myself along the way (Enjoy the three years)

- Be able to withstand unexpected outgoings along the way with no selling of any investments

The Review

As the three years for this challenge have now come to an end, it’s time to review my progress against the previously outlined success criteria. It’s hard to believe in some ways that this has come around so fast but then again a lot has happened during these three years not least of all a global pandemic and I have done lots of things so it’s been fairly jam packed for me with lots of life changes to boot. Let’s get straight into it and see how I did!

Success Criteria 1 – Invest £54,000 (£1500 a month)

Well…This is a very easy criteria to measure. I am pleased to announce that from December 2019 until December 2022 I have invested exactly £1500 a month and not a penny more or less which gives a grand total of…drumroll….£54000! I have got to admit that whenever I think of that total figure – I am amazed that I have managed to save so much money. The thought of saving £2000 a year would of seemed very difficult just over 8 years ago. I could barely save £100 a month back then. This is a big tick in the box for sure for the first success criteria.

Outcome: SUCCESS!

Success Criteria 2 – No Depriving myself along the way

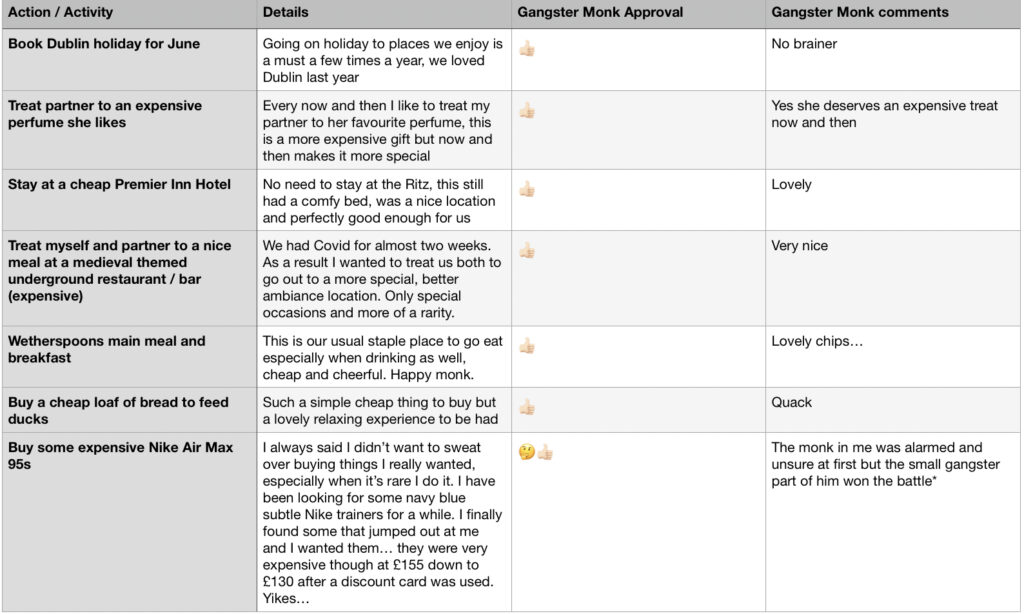

Now this particular success criteria is much more subjective and relative than the last for sure. Deprivation and feeling deprived is very personal and I guess you will have to just take me at my word on this one for the most part and rely on my own judgement on it :D. For me, being deprived is not being able to spend money on things that bring me joy or that help negate life’s imperfections and frustrations. It is when money can be in essence used to lubricate everyday life in positive ways.

For me this includes spending money on all the essentials, good quality food, general house bills, fast Internet, some TV entertainment packages to things such as going out with friends and family, gifting, going on holidays and trips away, buying items that give me great practical benefit and experiences in of themselves. It includes not having to penny pinch all the time, not being worried about unexpected outgoings, not living so close to the bone that pay day matters and is watched closely. What it does not mean is buying fancy cars, brand name everything, status symbols, 5 star hotels etc. there is no keeping up with the joneses in any of this but if I want a new iPad (which I always have loved) then I will get one…once mine is 5 years old that is.

So the question is, has saving £1500 a month for three years straight caused me some noticeable deprivation along the way? The answer is a confident No, it really hasn’t. There are clearly some things I could have bought more of or when I had a more expensive month I may have had one or two less outings or forgone a purchase for a while longer but this is just a normal disciplined life and these scenarios will always be the case. There will always be financial constraints. The success criteria being met here for me is proven from the fact I never felt like me saving was holding me back. I still got to buy gifts, I still go to go to Amsterdam, Ireland, trips to London, Liverpool. Nottingham, Manchester, Blackpool etc. I got to buy a new iPad, smart watch, PS5 and other things that I wanted after careful deliberation on their value to me of course… The other big validation of this success criteria is the fact that at no point did my partner call me tight or even passively hint at it along the way 😂. This is therefore a tick in the box for sure.

Outcome: SUCCESS!

Success Criteria 3 – Able to withstand unexpected outgoings along the way with no selling of any investments

Onto the third and final success criteria and now everything rests on the result of this. Similar to the first criteria, this is very much black and white too. Was I able to manage unexpected outgoings along the way as proven by not needing to sell any of my existing investments at any point or take out any loans or use credit cards etc. Up until the last 6 months of this challenge, the answer to this was a resounding clear cut yes. I managed to get through unexpected outgoings that cropped up and never felt the need to watch my bank fearful of something coming out I didn’t expect pushing me into an overdraft or really needing to know when pay day actually was. The last six months however have been a different story which deserves its own little write up which will follow now.

Photo finish Ending

When it comes to surviving unexpected outgoings and not having to sell any of my investments during the last six months, it has not been so easy and plain sailing. I mentioned in a previous blog post about having a huge unexpected vets bill of in the end almost £4000. This was following on from the value of my crypto punt falling by 90% which I always knew could happen and it was an amount I could live without hence risking it in the first place. It turns out though that had I not risked that, I would not of had anywhere near as much of a rocky road towards the end of this challenge…

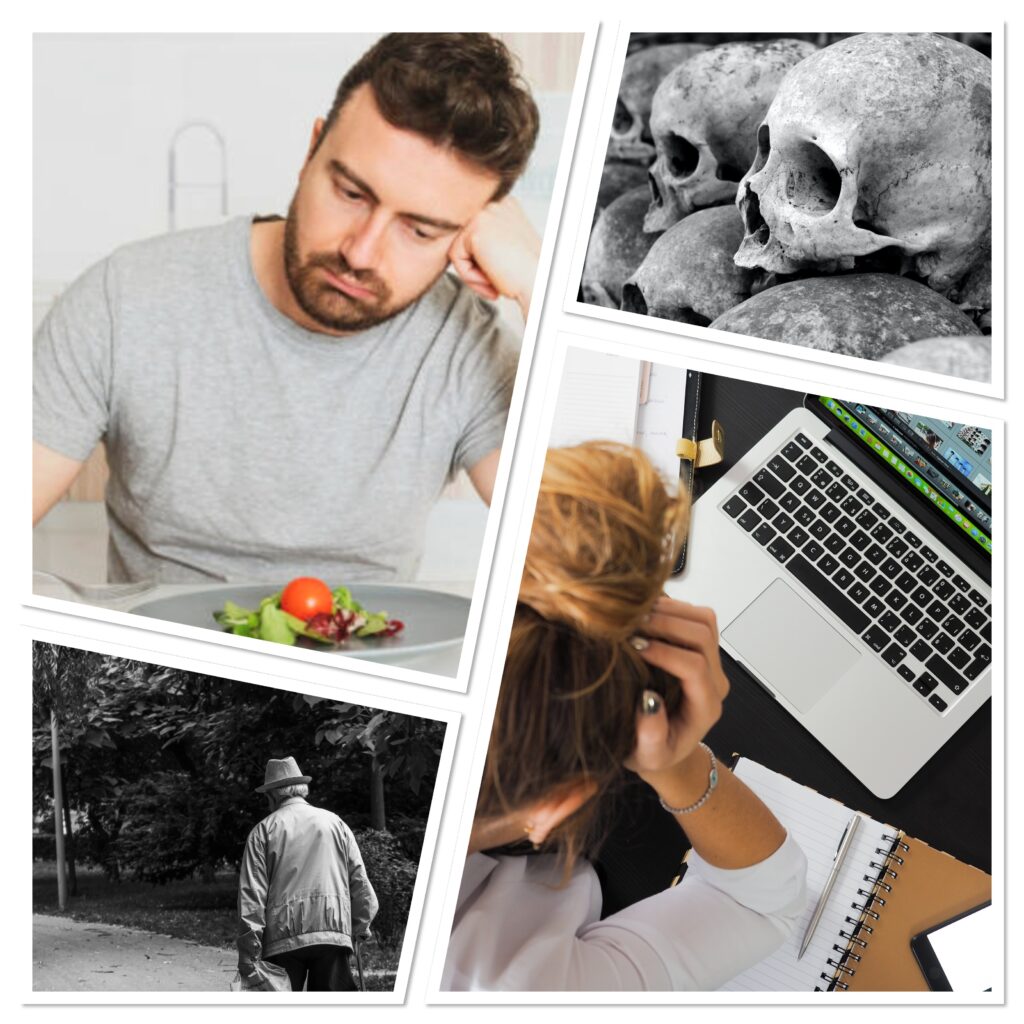

What made the last three months in particular so hard was that I had an unexpected car bill of £1000 and all this was happening at a time where I needed to spend money on Christmas, previously planned and booked trips away and things such as trips to the German market that we always go on. I did not want to deprive myself by stopping all these things completely but I had to do them in very carefully planned ways with micro budgets almost for each whilst cancelling others. I cut down the amount I spent on Christmas, I had more pre drinks at home on outings and I was even more selective when it come to food purchases. I stuck to many simple food due to cost reasons (beans on toast anyone?) I was really planning out what I would be eating for the next week at a low level at times and knowing when I’d need to buy the next thing. I had days and days that were zero spend days and I was even having to watch my bank account daily as I was within £17 of my overdraft at one point desperately waiting to be paid. I kept checking my bank to see if my pay had gone in yet, something I have been fortunate not to have had to do in a long time.

Despite all of the above being hard at times, it was never lost on me during this time that what I was feeling was simply a sampling and revisiting of the past for me and was not at all like it would feel for those that didn’t have the possibility of selling investments to instantly solve acute problems. I was simply so almost desperate to complete the goal that I put myself through that willingly because I hoped it would make victory ever sweeter and I couldn’t bare the crypto punt ultimately costing me this goal.

Only two weeks ago, with only a matter of days before I would be able to invest the final £1500 – During this same time of being so close to the red, I was involved in a car crash. We were all safe which was the main thing of course but I was absolutely gutted at the thought of having to pay for the insurance excess at the very minimum of putting a claim in which would have come to £400. That was £400 I did not have. After cleaning up the damage to the front left hand side of my car, it did not seem quite as bad as it originally looked. It was indented with damage through to the black bumper plastic, it was heavily scuffed and was certainly noticeable and there was no doubt that It would cost way more than £400 to fix. I decided to get it looked at and checked to see if the car was road safe and mot passing safe which was the only thing that mattered to me now. The car was 11 years old, had some other battle wounds and I was willing to think of it as a cool scar for the sake of not letting it cost me success on Project 2235 :D. The car was found to be structurally and MOT safe, I could breath a huge sigh of relief…I therefore can say with pride that this success criteria indeed has a tick.

Outcome: SUCCESS!

Project 2235 – Achieved!!!

It feels so good to have achieved success in Project 2235. It feels like I can now ease off the gas slightly and enjoy the ride even more. I especially feel grateful to be able to share the journey with people like you who are along for the ride. Thanks for your support in the comments that you leave – feeling part of this FI community has made this all the more possible without a doubt.

Financial Update – £250,000???

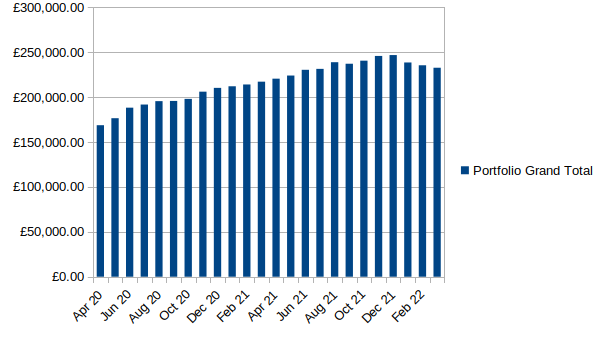

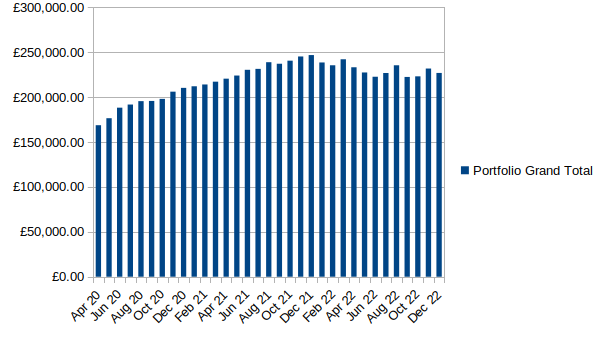

So for those that want to know if I actually hit the £250,000 icing on the cake target and to see my actual numbers at the end of this. Here is my December update.

Financial Update – Dec 2022

The below figures are taken from the 22nd of December.

- Monthly investment (Jul 22 to Dec 22) – £1500 each month

- Savings rate (Jun 22 – Dec 22)– 55% average each month

- Investment portfolio – £226,310.82:(

- Cash is King fund – £429.48

Crypto Punt – £0(liquidated this, sore subject :D)- Emergency fund – £100

Big expenses / holiday fund – £0(Cash is King now contains this category from now on)

Total Liquid Funds = £226,840 🙁

As you can see from the graph above, Market conditions and the wind blowing against me during the past 6 months has meant that I unfortunately could not hit the £250,000 Target. It’s a shame but I know I will get to this eventually, it’s only a matter of time! It got so close to this figure last year as well with the highest I saw it being close to £247,000 – Almost briefly did it!

I have now also written off the crypto losses as I needed the money that I had left invested to use against unexpected outgoings. I have merged the big expenses fund into Cash is King as I won’t be separating the cash pots quite as much as I did in the past from now on.

Celebration time!

Despite it being a shame I couldn’t hit the major milestone of £250,000, it was now time to celebrate!

I knew it was partially against my control to hit that number and that the market would determine this as mentioned earlier. That’s why I set the investing of £54,000 and not depriving myself along the way whilst weathering the storms of the unexpected as the criteria for success. How did I celebrate this? Did I go to Dubai?, New York? Did I rent out an entire restaurant and wine and dine my closest friends and family…No, no I did not. What I did instead was commandeered a normal winter Liverpool trip to be partially about celebrating the achievement. It was in essence a souped up, push the boat out a little further Liverpool trip in a slightly nicer hotel.

On the night which I kind of loosely marked as the celebration night, we started off with some Asti Wine followed up by us going out to eat. We went to Byron Burger instead of our frequent spoons which has my favourite burger, sweet potato fries and onion rings (expensive but we were celebrating after all). We partied like we normally do but stayed out even longer. That was enough for me. It felt really sweet and then things carried on as normal – life goes on.

Post Project 2235 Begins…

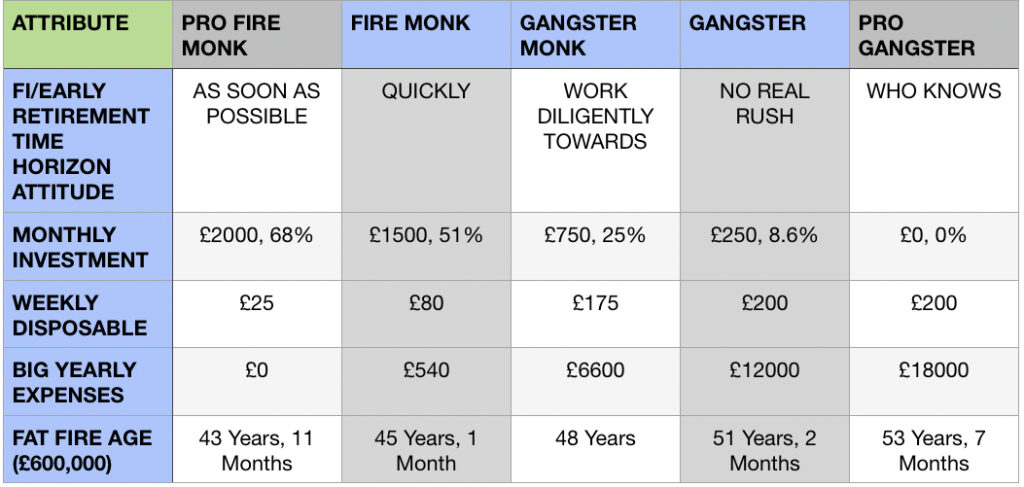

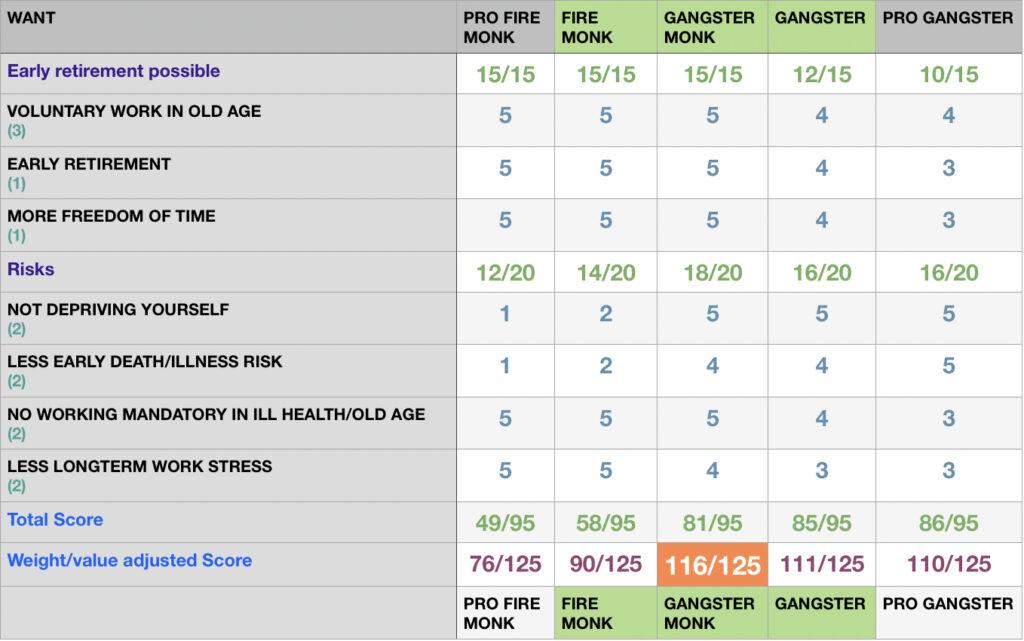

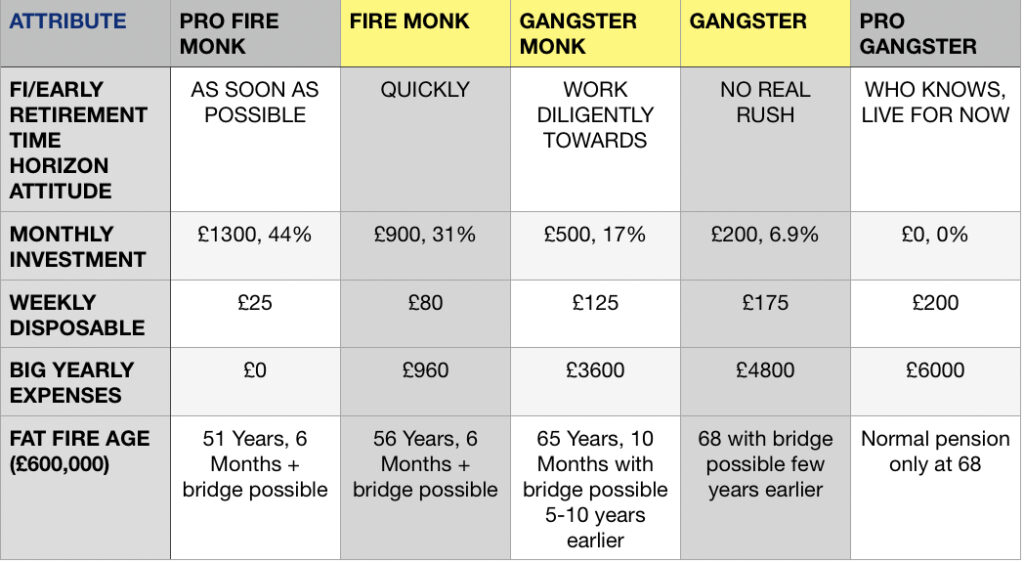

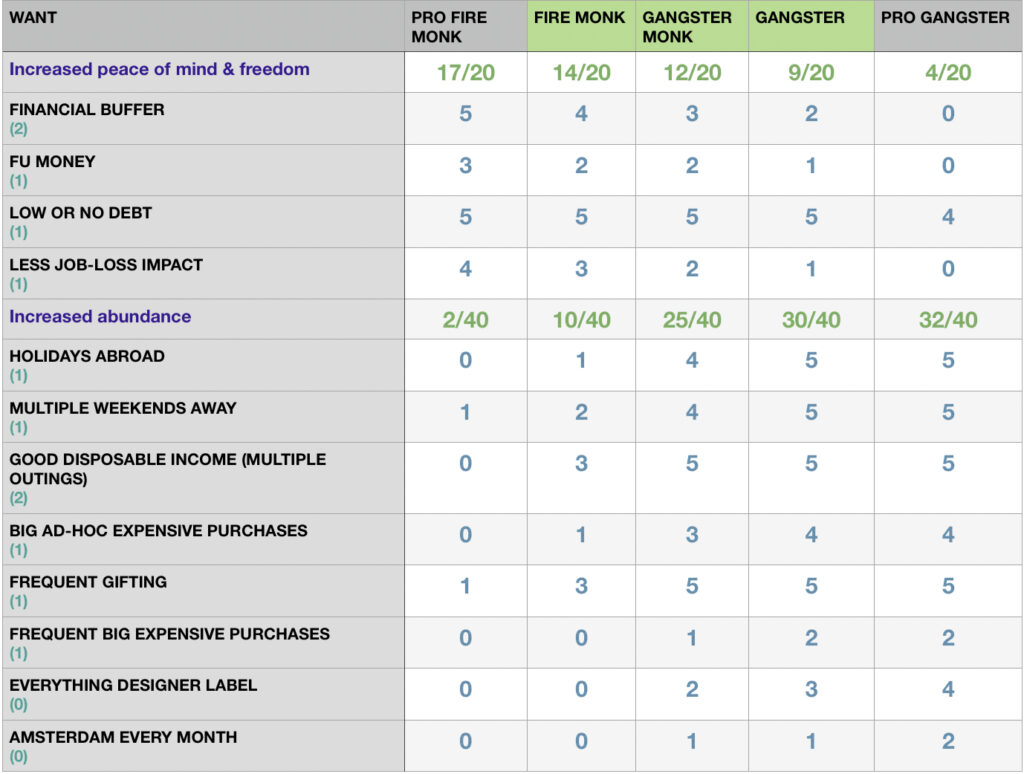

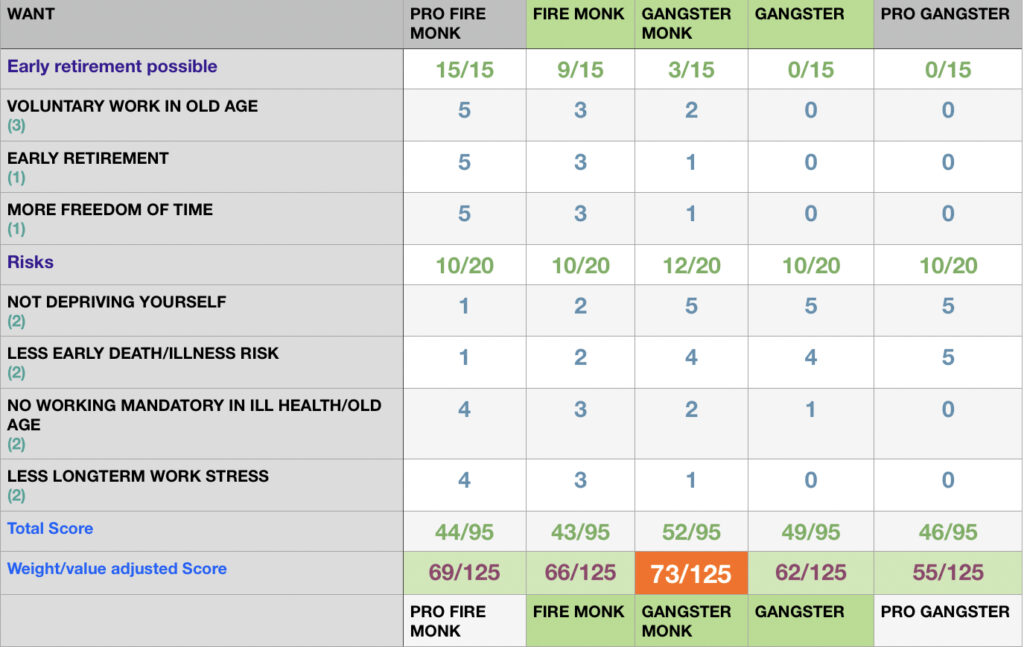

I now officially start the journey of Post Project 2235. This phase will no doubt be made up of other projects, challenges and goals but for now the only FI Journey related goals and plans of mine are to lower my investments by half on average to ensure I can live the Gangster Monk lifestyle going forward and to continue to invest so that my current plan of being able to retire at no later than 50 should I choose is still achievable.

Thanks for reading my post :), I hope you all have a Great Christmas and a happy new year!

TFJ